Tag Archives: Mortgage

My Best Advice to Veterans Buying Homes — A Letter from John Inzeo, Vice President of Wisconsin Mortgage Corporation

As we celebrated Veterans Day in November, we have had ample opportunities to reflect on the men and women who have served our country and preserved our freedoms. Past, present and future Veteran’s deserve our never-ending support as we …

Read More

Wisconsin Mortgage Corporation Recommends: How Do I Know if I’m Ready To Purchase a House?

Homeownership has been creeping into your head, and you are tired of paying for rent. Purchasing a house may seem like a good idea, but how do you know if you are ready? There are a lot of pre-qualification …

Read More

Wisconsin Mortgage Corporation Recommends These Alternatives to Putting 20% Down on a Home Loan

It has been repeated numerous, numerous times: If you want to buy a house, you need a 20% down payment. Fortunately, you don’t have to put 20% down anymore. “It’s a myth that all homebuyers must have a 20% down …

Read More

Wisconsin Mortgage Corporation Reports: What does it mean? Mortgages defined.

Whether you’re a first-time homebuyer, a current homeowner or in the market for a new home, you may have a tough time sorting through mortgage terms discussed by real estate agents, lenders, real estate attorneys and other real estate professionals. …

Read More

Wisconsin Mortgage Corporation has Lowest Closing Cost in the Nation

According to Bankrate.com, Wisconsin has the fifth-highest closing cost in the nation at $2,706 — Wisconsin Mortgage Corporation actually has the lowest at $1,034. For the survey, Bankrate.com requested good faith estimates for a $200,000 mortgage loan from up to …

Read More

Wisconsin Mortgage Corporation Recommends These Tips to Buyers

Financing a new home can be both a stressful and satisfying experience. Unfortunately, in today’s lending environment, much of the stress is created during the process of getting your loan approved. A good lender will prepare you for the financing …

Read More

Wisconsin Mortgage Corporation Recommends These Tips When Considering a Mortgage

Buying a house is a huge milestone in a person’s life, whether you are 18 years old or 80 years old! Before you begin the process, it helps if you know what to expect when considering a home mortgage. Here …

Read More

Shorewest Reports: What does it mean? Real Estate Terminology defined.

Whether you’re a first-time home buyer, a seller, or in the market for a new home, you may have a tough time sorting through real estate terms spewed be real estate agents, lenders, real estate attorneys and other real …

Read More

Ask an Agent: Pre-Approval versus Pre-Qualification

Welcome to Ask an Agent. If you have any real estate questions you want answered, email us at [email protected] and we’ll feature your answer on an upcoming blog post. Question: What is the difference between mortgage pre-approval and pre-qualification? It’s important to …

Read More

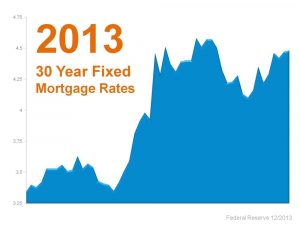

2013 versus 2014: More about Mortgage Rates

The statistic illustrated above shows the startling difference in net worth between homeowners and renters. Homeowners’ average net worth is $174,500, while renters average only $5,100. This means the average homeowners net worth is over 30 times greater than a …

Read More

Sign in

Sign in