You have heard repeatedly that putting money down on a home will repay you with equity. But that’s hard to remember after a large down payment and closing costs! However it is an important piece of information to remember when buying a home. According to Pulsenomics’ most recent Home Price Expectation Survey, home prices are expected to appreciate 3.22% per year on average and grow by 17.3% cumulatively over the next five years.

According to Pulsenomics’ most recent Home Price Expectation Survey, home prices are expected to appreciate 3.22% per year on average and grow by 17.3% cumulatively over the next five years.

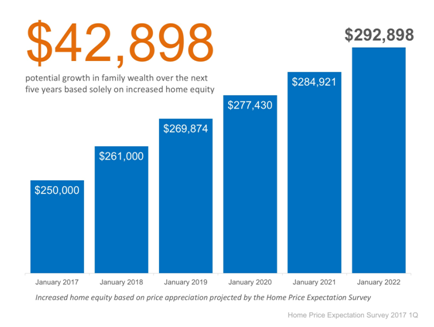

This means that homeowner’s equity is supposed to significantly rise. Let’s look at the below example.

If someone purchases and closes on a $250,000 home, how much equity will they earn over the next five years if we look at the projected increase in the price of the home? In just one year this homeowner has gained $11,000 in equity! If rates progress like experts predict they will, home prices will rise by 4.4% this year alone.

In just one year this homeowner has gained $11,000 in equity! If rates progress like experts predict they will, home prices will rise by 4.4% this year alone.

When looking longer term over a five-year period, a homeowner’s equity will increase by nearly $43,000! In many cases, home equity is one of the largest portions of a family’s overall net worth.

So when you are asking yourself, should I buy a home? The answer is yes! Buying a home is like having a forced savings account and not to mention you are building equity you can borrow against in the future. Talk to your Shorewest, REALTOR® today about buying your own home! #ShorewestRealtors #BuyingaHome #Equity

Source Credit: Keeping Current Matters

Tags: buying a home, Equity, keeping current matters, Mortgage, net worth, shorewest family, Shorewest Realtors

Categories: First Time Home Buyers, Home Buying, Homeowner, Mortgage, Real Estate Tips

Leave a Reply